Bloated insurance premiums weighing you down? Received a traffic violation that landed you an SR-22, an unwelcome companion on your insurance policy? Fear not! I’ve navigated these murky waters before and emerged victorious. Let me guide you through the labyrinth of having an SR-22 removed, restoring your insurance freedom and keeping more of your hard-earned money in your pocket.

Image: www.agilerates.com

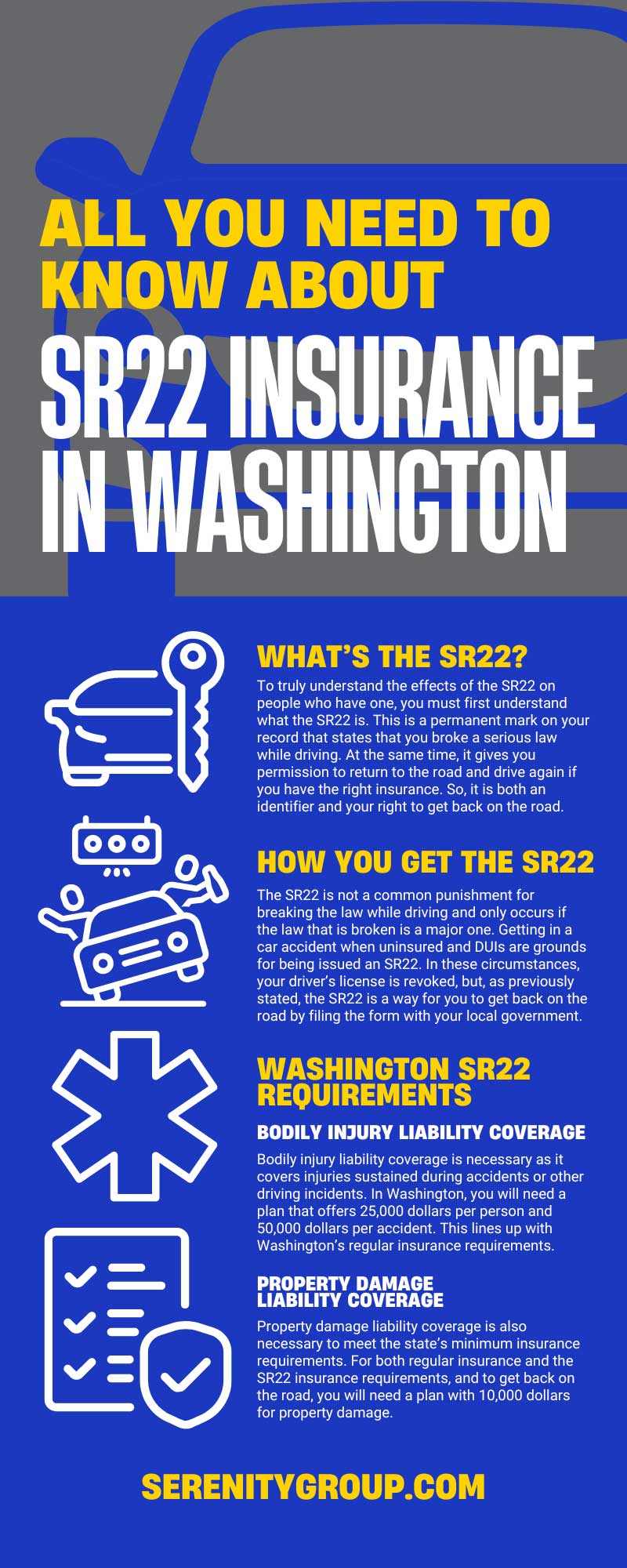

For those unaware, an SR-22 is a form of financial responsibility implemented after certain traffic violations. Essentially, it’s a scarlet letter on your insurance policy, serving as an indicator to the world that you’ve committed a traffic infraction deemed serious enough to warrant this marker. However, its presence isn’t permanent, and with some determination, you can liberate yourself from its clutches.

Understanding the SR-22 Duration

The duration of your SR-22 adventure varies depending on your state’s regulations. Typically, the standard waiting period ranges from three to five years. However, some states may impose longer or shorter terms, with some stretching up to ten years. It’s crucial to familiarize yourself with your state’s rules to determine your SR-22 sentence.

Steps to Emancipate Yourself from the SR-22

Once you’ve completed your SR-22 sentence, it’s time to sever ties with this unwelcome chaperone. Here’s a step-by-step guide to removing the SR-22 from your insurance:

- Proof of Compliance: Obtain the necessary documentation from the relevant authorities to demonstrate your compliance with the SR-22 requirements. This may include copies of driving records, insurance statements, or court documents.

- Notify Your Insurance Company: Reach out to your insurance provider and inform them of your completed SR-22 obligation. Submit the proof of compliance, allowing them to verify your eligibility for SR-22 removal.

- State-Mandated Processes: Certain states require additional steps, such as a written request or a license reinstatement fee. Be sure to adhere to any state-specific protocols to ensure a smooth and timely SR-22 removal.

- Renewal Time: SR-22s typically expire at the same time as your insurance policy. If your SR-22 is approaching its end date, renew your insurance before it expires to ensure uninterrupted coverage and avoid any lapses.

- Monitoring Your Policy: Once the SR-22 is removed, keep an eye on your insurance policy to confirm its absence. Errors can occur, and it’s essential to catch any discrepancies and rectify them promptly.

Expert Tips for a Successful Removal

To increase your chances of a seamless SR-22 removal, consider these expert insights:

- Maintain a Clean Driving Record: Avoid traffic violations during your SR-22 period. Any further offenses may extend your SR-22 requirement.

- Stay in Touch: Maintain regular communication with the relevant authorities and your insurance company. Keep them updated on any changes and seek clarification if needed.

- Seek Professional Help: If you encounter any difficulties or complexities, don’t hesitate to seek guidance from an insurance professional or a licensed driving record specialist.

Image: serenitygroup.com

FAQs for the Curiosity-Driven

Q: How much does it cost to remove an SR-22?

A: The cost of SR-22 removal varies depending on your state, insurer, and the length of time the SR-22 was in effect.

Q: Does my driving record remain clean after SR-22 removal?

A: The traffic violation that triggered the SR-22 requirement will remain on your driving record for a specific period, as determined by your state’s regulations.

Q: Can I be denied insurance after the SR-22 is removed?

A: An SR-22 removal does not guarantee your insurability. Your insurance company may still consider your driving record when determining your coverage options and premiums.

How To Remove Sr22 From Insurance

Conclusion

While dealing with an SR-22 can be an insurance headache, it’s not an insurmountable obstacle. By understanding your state’s requirements, following the removal steps diligently, and seeking guidance when needed, you can reclaim your insurance freedom and bid farewell to the burden of the SR-22. Remember, with perseverance and a dash of insurance know-how, you can navigate the road less SR-22’d.

So, are you ready to embark on your SR-22 removal journey? Let’s get started and liberate your insurance from the clutches of this unwanted companion.